Excitement About Wealth Management

Wiki Article

The Ultimate Guide To Wealth Management

Table of ContentsSome Of Wealth ManagementThe Wealth Management IdeasExcitement About Wealth ManagementThe Best Strategy To Use For Wealth ManagementThe Buzz on Wealth ManagementThe Greatest Guide To Wealth Management

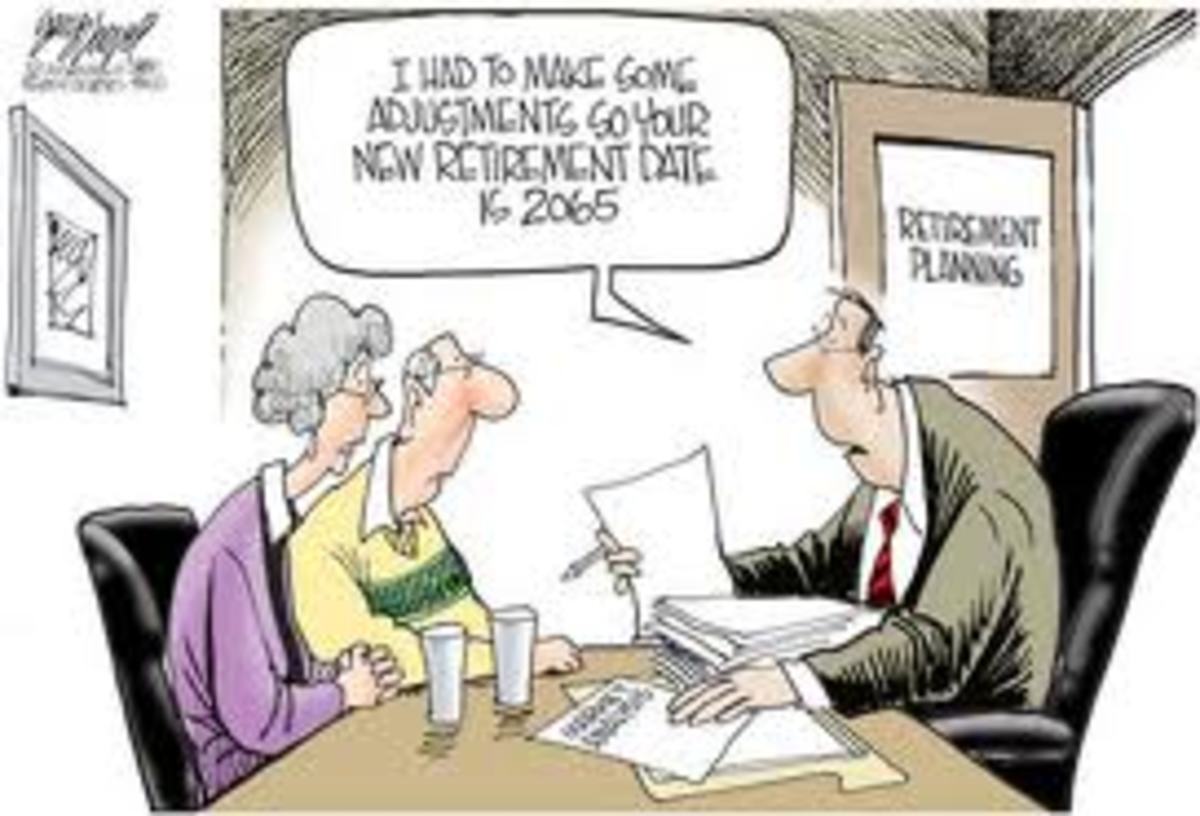

Sadly, many do not have accessibility to an employer-sponsored retirement, such as a 401( k) strategy. Even if your company doesn't use a retirement, you can still conserve for retirement, by placing money in a Specific Retirement Account (INDIVIDUAL RETIREMENT ACCOUNT). Slow-moving and stable victories this race.While your retired life might seem a lengthy means off, you owe it to on your own to look towards the future as well as begin thinking of what you can do today to help make certain a secure retirement tomorrow. Time might be on your side, if you ask some of the retired people you understand, they will possibly inform you that saving for retirement is not as easy as it originally shows up.

Many people don't recognize the potentially severe results of rising cost of living. At 35 years, this amount would be further minimized to just $34. Thus, it is vital to seek retired life financial savings cars that have the best possibility of exceeding inflation.

Getting The Wealth Management To Work

The sooner you acknowledge the impacts that financial pressures can carry your retirement revenue, the more probable you will be to take on methods that can help you attain your lasting purposes - wealth management. Being proactive today can help raise your retired life financial savings for tomorrow.If preparing for retired life looks like it may be plain or challenging, reconsider It's your possibility to consider your goals for the future as well as form a brand-new life resided on your terms. Taking a bit of time today to think of your life in the future can make all the difference to your retirement.

A retired life strategy helps you get clear on your objectives for the future, such as exactly how you will spend your time, where will certainly you live and also whether your spouse really feels the very same. Recognizing when you prepare to retire makes it much easier to prepare.

Some Known Factual Statements About Wealth Management

A retirement cost savings technique that considers your earnings, incredibly equilibrium, budget plan and staying working years can give the increase your incredibly requirements. Senior citizens and also pre-retirees face some one-of-a-kind dangers when it pertains to their financial investments. A retirement can aid you manage vital threats and browse around this site also ensure your investments adjust to match your phase of life.

A you could try here retirement strategy will discover your alternatives including incomes from part-time work, investment income, the Age Pension and also incredibly savings. Dealing with a knowledgeable retired life organizer can aid supply economic safety and security and satisfaction. It can offer you self-confidence that you get on track to be able to do the points you desire in retired life.

Here's why you should start preparing beforehand instead than when it's too late. Retirement takes you to a brand-new phase of your life where you can truly make time for on your own and enjoy tasks that you have not had the ability to take notice of throughout your job life.

Unknown Facts About Wealth Management

Most of us follow a certain lifestyle, as well as with age, it gets deeply incorporated into our daily habits. The way of life we lead today is due to the earnings we receive on a monthly basis. Spending in a retirement is required to guarantee this same requirement of living post-retirement. That will certainly aid you with a stable revenue every month also after retiring.

This indicates that an individual will have to pay even more for all expenditures in the future. Hence, while performing crucial retired life preparation, you can consider this determinant and also produce an adequate retirement fund for your future to live a serene life. After your retired life, you should not depend upon any individual, especially your loved ones.

Not known Details About Wealth Management

With all these benefits and also more, you can not reject the reality that this is undoubtedly an excellent investment opportunity to give up on. That's appropriate start today!. Currently that you have recognized the significance of retired life preparation, you can start by fine-tuning your clever retirement plan today.

Preparation for retirement is a means to help you keep the same quality of life in the future. You could not desire to work forever, or be able to completely depend on Social Security. By filing early, you'll sacrifice a part of your benefits.

As well as your advantage will actually enhance if you can postpone it better, up till age 70. (since they desire or have to), as well as lots of retire later (again, due to the fact that they desire or have to) - wealth management.

When should you begin retirement preparation? Even if you have not so much as considered retired life, every dollar you can conserve currently will certainly be much valued later on.

Report this wiki page